News

State Legislators Were Busy in 2015: Laws and Incentives Year in Review

What types of incentives and laws did state legislators and others enact in 2015? State legislators, as well as governors and utilities, were busy in 2015 introducing and enacting new incentives, laws, and regulations related to alternative fuels, advanced vehicles,...

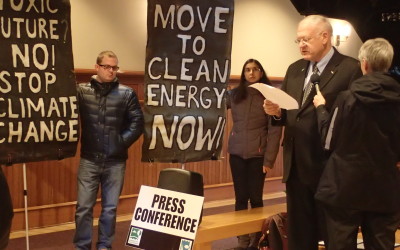

30+ organizations call on Mayor Harp to act on climate

Today the Greater New Haven Clean Cities Coalition along with over 30 other organizations called on the administration of Mayor Toni Harp to continue addressing climate change by updating the city's 2004 climate action plan with new goals and targets. The...

Federal Legislation Update: Alternative Fuel Tax Credits

On Friday, December 18th, President Obama signed the Consolidated Appropriations Act of 2016 (H.R. 2029). Division Q, the Protecting Americans from Tax Hikes Act (PATH Act), retroactively extends many tax credits. There are several PATH Act provisions with...

Redesigned Clean Cities Website Offers Bold New Look, Enhanced User Experience

What should I know about navigating the revamped Clean Cities website? As the work of Clean Cities continues to grow, the Clean Cities team is committed to ongoing communication about the program's resources and accomplishments. Last month, Clean Cities launched a new...

DEEP offers funding for EV charging stations

DEEP is now accepting applications from private entities for its Public Charging Station Incentive Program. Awards of up to $10,000 are available for installing a dual-head charger or two single-head chargers that are publicly accessible. For more details please...

Renewable Natural Gas: Repurposing Waste to Fuel Vehicles

What is renewable natural gas and how can it be used to fuel vehicles? Renewable natural gas (RNG) is pipeline-quality natural gas made by collecting and purifying biogas, the methane produced from decomposing organic matter. Biogas can be collected from sources such...

Our updated website is designed for you!

Greater New Haven Clean Cities Coalition launched our new website that focuses on improved navigation and pulling resources together. Now visitors can easily look at each alternative fuel and click on the tab about each one and find a variety of resources to find...

New Public Fleet EV and Public Workplace EV Charging Station Incentive Program

DEEP is pleased to announce that funding is now available for municipalities and state agencies to receive funding for fleet electric vehicle (EV) purchases in conjunction with workplace charger installation. Municipalities and state agencies can demonstrate...

Six Tips to Cut Fuel Costs and Unnecessary Idling When Winter Hits

How can I improve my gas mileage while driving this winter? Whether taking that long-awaited ski trip or just commuting to work in the frigid weather, there are several things you can do to improve your fuel economy and save money in the wintertime. Why You Get Worse...

Propane School buses: Better for students, schools, & the environment

Learn the basics of how propane autogas school buses are better for students, schools, and the environment. The video touches on the differences between diesel and propane school buses.

Alt Fuels are Taxed the Same? Think Again!

Are fuel taxes equal for all fuels? In theory, if all motor fuels were taxed equitably it would ensure tax consistency among jurisdictions and reduce consumer burdens. In practice, motor fuel taxes vary widely between jurisdictions and across fuel types. This is...

AltWheels Fleet Day

AltWheels Fleet Day is the largest meeting of corporate and municipal Fleet Managers on the East Coast. Come see and hear the latest in fleet transportation technologies, alternative fuels and fleet management practices.