Contrary to popular belief, some new EVs are cheaper than similar gas-burning cars in CT

Rebates on the Chevy Bolt, Tesla Model Y, Hyundai Kona Electric, and Toyota Prius Prime can make them cheaper than conventional counterparts.

by Geremy Schulick

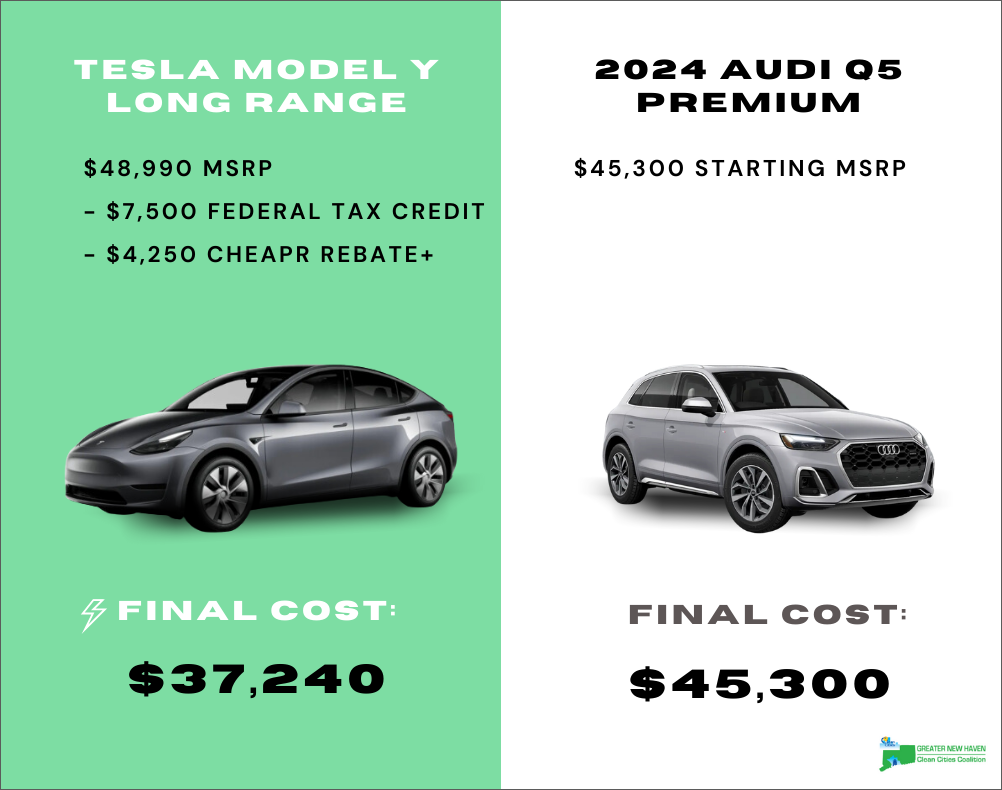

Electric vehicles are not only integral to reducing CT’s stubbornly high transportation emissions, but, without much fanfare, they have gotten dramatically cheaper. Combining the federal tax credit available for many EVs with the Connecticut Hydrogen and Electric Automobile Purchase Rebate (CHEAPR) can slash up to $11,750 off the sticker price, making a number of EVs cheaper than comparable internal combustion engine (ICE) cars, even before the fuel savings kick in.

What’s more, as of this year, car buyers can subtract the federal $7,500 credit immediately off the purchase price, as opposed to having to wait until they file their tax return, and they can receive the credit even if they have no tax liability. CHEAPR, which can be as high as $4,250, is also a point-of-sale rebate.

Here are a few cost comparisons:

You can buy a Chevy Bolt EV for almost $3,000 less than a Kia Rio, a comparable ICE subcompact hatchback. If the Bolt EV is too small for you, check out the Bolt EUV which is a crossover that just costs $1,300 more. Though GM has paused Chevy Bolt production while it tools up for the next generation, 2023 models are still available at at least one Connecticut dealer. So if you’re interested in buying a Bolt any time soon, now would be the time to snag one. The Bolt will also save an estimated $201/year in fuel costs compared to the Rio.

Notable also will be the Chevy Equinox EV, arriving at dealerships in the next few months, which with a starting MSRP of $35,000 will be $3,350 cheaper after incentives than the ICE Equinox, which starts at $26,600.

Now that the Tesla Model Y’s starting MSRP has sunk to $43,990, the base level Y is cheaper than the Audi Q5’s starting MSRP even before incentives are factored in. Then once those are subtracted from the price, even the Long Range upgrade of the Y (which features AWD like the Q5) will cost over $8,000 less than the Q5. The Y Long Range will also save an estimated $1,310/year in fuel costs compared to the Q5.

If you lease a Hyundai Kona Electric SE, it’s $3,325 cheaper than its gasoline counterpart. More info on leasing in a bit. The Kona Electric will save an estimated $380/year in fuel costs compared to the Kona as well.

You can lease a Prius Prime plug-in hybrid (PHEV) for slightly less than a Camry. If you are like most Americans, your daily commute will be electric-powered, and if you’re on a long trip and can’t find a charger, no problem- PHEVs automatically revert to hybrid mode after the battery is depleted and still get more efficient MPG than conventional cars. The Prius Prime will save an estimated $496/year in fuel costs compared to the Camry as well.

Federal incentive fine print

The federal tax credit eligibility is based on North American assembly and can sometimes even vary by the specific vehicle, so just clear that with the dealership and/or see this page where you can look up eligibility by VIN. Also, the buyer must fall below certain income thresholds and the car must not exceed a certain MSRP. See here for those specifics, and to check whether other EVs or PHEVs you might be interested in qualify.

If the car you’re interested in doesn’t qualify, there is often a workaround as long as you lease instead of buy. The IRS does not apply the American-made requirements to leases, so many dealers and customers have favored this option. Both the Hyundai and Toyota cost comparisons featured here assume this; their EVs/PHEVs are not eligible otherwise. Not all carmakers pass on the tax credits to lessees, though, so see this article for more info and check with the dealership, especially as lease offers can shift periodically and can vary by region

CT incentive fine print

CHEAPR also has some eligibility requirements. Vehicles only qualify if they fall below a $50,000 MSRP cap; here is a list of new vehicles eligible for CHEAPR. The $2,250 Standard Rebate just requires the vehicle be purchased/leased and registered in CT, and the additional $2,000 Rebate+ incentive is available to those who live in certain cities/communities or who fall below certain income thresholds. A few of the bigger eligible cities include New Haven, Hartford, and Bridgeport. You can download the full Distressed Municipalities list from this page to see if your town qualifies. If it does, then there are no income requirements.

So don’t believe the hype – you can affordably purchase an electric vehicle.

One of the greatest barriers to EV expansion has been the persistent and pervasive rhetoric that they are unaffordable for most people. This refrain among EV skeptics was part of what caused CT legislators to recently abandon the proposal to adopt California’s more ambitious EV adoption targets.

Here’s the truth: In Connecticut, there are now several EV models that can be obtained for less money than ICE counterparts. Some are below $21K after incentives, and those still have a range of 200 miles or more. The bottom line is that if you want an affordable EV, you can get one. The myth that EVs are always more expensive than conventional is just wrong.

Kelley Blue Book recently wrote, “In recent months, price parity between EVs and ICE has almost seemed possible… A year ago, the EV premium was more than 30%. Today, it’s less than 10%.” And EVs will just continue getting cheaper in the years to come as the technology becomes more mainstream and more mass market models become available. So the next time you’re in the market for a new car, don’t just assume EVs are out of your price range because of the hype!

(Used EVs can be a bargain too! Used EVs are a great option to consider, especially as prices have also been getting much cheaper. For used EVs, there is a federal tax credit of up to $4,000 and a CHEAPR rebate of up to $3,000.)

Please feel free to write to us with any questions or comments at info@nhcleancities.org

———-

MSRPs and incentive availability current as of 3/6/24. MSRPs and incentives can vary depending on location and timing.

All fuel savings figures were calculated using fueleconomy.gov’s Savings Calculator, assuming average CT residential electricity prices of 28¢/kWh according to Energy Sage and average CT regular gas prices of $3.29/gallon and premium gas prices of $4.23/gallon according to AAA, as of 3/6/24.